The Importance of a $1,000 Emergency Fund Before Working On Other Financial Strategies.

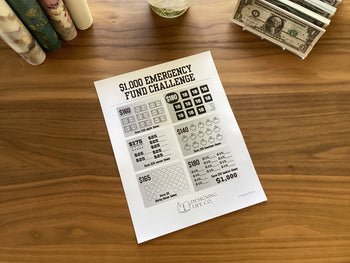

Free Emergency Fund Savings Challenge below!

When embarking on your financial journey, prioritizing a $1,000 emergency fund is crucial. This initial cushion serves as a safety net for unexpected expenses, such as car repairs, medical emergencies, or urgent home maintenance. By having this fund readily available, you can handle these unforeseen costs without derailing your financial progress or resorting to high-interest credit card debt. It's a fundamental step that provides peace of mind and financial stability.

Building a $1,000 emergency fund before tackling other financial goals like investments or debt payoff is a strategic move. It allows you to focus on your long-term objectives without constant worry about immediate financial disruptions. For instance, if an unexpected expense arises and you don’t have an emergency fund, you might have to divert funds from your debt repayment or investments, which can delay your progress and lead to additional costs. This buffer ensures that your financial plan remains on track even when life throws you a curveball.

Moreover, a $1,000 emergency fund instills a sense of discipline and financial responsibility. It’s often the first step in creating a broader habit of saving and managing money wisely. Once you’ve achieved this milestone, you’ll likely feel more confident and motivated to pursue larger financial goals, such as a more substantial emergency fund, retirement savings, or paying off significant debts. In essence, this initial savings acts as a foundation, making other financial strategies more manageable and less stressful.

By prioritizing this small but significant financial cushion, you set yourself up for long-term success, ensuring that you can navigate life's uncertainties without compromising your broader financial aspirations.

Below is a link to download my free, six-part savings challenge to aid in your savings for your emergency fund.